- The Launch Dock

- Posts

- The Launch Dock

The Launch Dock

The Financial Reformation: A Movement For Truth, Accountability, and Economic Restoration

Author: Lyndsay LaBrier — Merchant Ship Collective

In 1978, the U.S. Supreme Court issued a ruling that quietly reshaped the financial future of every American: Marquette National Bank v. First of Omaha.

The decision allowed banks to charge interest based on the laws of the state where the bank is located — not where the borrower lives.

South Dakota eliminated its interest caps. Banks moved in. And overnight, the American people lost 200 years of state-level consumer protections.

This wasn’t democracy. This wasn’t economics. This was a loophole — and for 46 years, the American people have paid the price.

A System of Extraction, Not Protection

The modern financial system — credit cards, insurance, and loans — functions less like a safety net and more like a siphon.

Credit cards extract through interest. Insurance extracts through premiums. Loans extract through long-term repayment traps.

Together, they form a unified system that drains household wealth while corporate profits grow.

This is not accidental. It is structural.

Credit Cards: The Interest Engine

With interest rates often exceeding 20–30%, Americans pay billions in interest annually — far more than they pay on the principal they borrowed.

This keeps families in revolving debt, unable to build savings or invest in their futures.

Credit cards no longer function as temporary tools. They function as permanent revenue streams.

Insurance: A System Built On Fear And Mandates

Insurance was originally designed as a cooperative model: shared risk, shared protection.

Today, it is a for-profit extraction system.

Families pay thousands per year in premiums yet still face:

High deductibles

Denied claims

Surprise billing

Coverage gaps

Meanwhile, insurers report record profits.

If families placed even a portion of premium costs into savings or community financial networks, many would be more protected than they are under the current system.

Lobbyists ensure this alternative remains out of reach.

Loans: Debt as a Life Long Condition

Loans — once tools for advancement — have become long-term burdens.

Student Loans

Borrowers often pay more in accumulated interest than the original cost of education.

Auto Loans

72–84 month loan terms have normalized, trapping Americans in negative equity cycles.

Personal Loans

Marketed as relief, they often deepen financial distress.

Mortgages

Home-ownership, once the foundation of American stability, has become prohibitively expensive due to investor-driven inflation and steep mortgage costs.

Lobbyists: The Architects of Financial Policy

The financial industry is not merely influential — it is embedded in the legislative process.

Lobbyists:

Draft legislation

Influence committee priorities

Shape regulatory interpretation

Pressure lawmakers

Protect corporate interests over public good

This is not representation. It is policy capture.

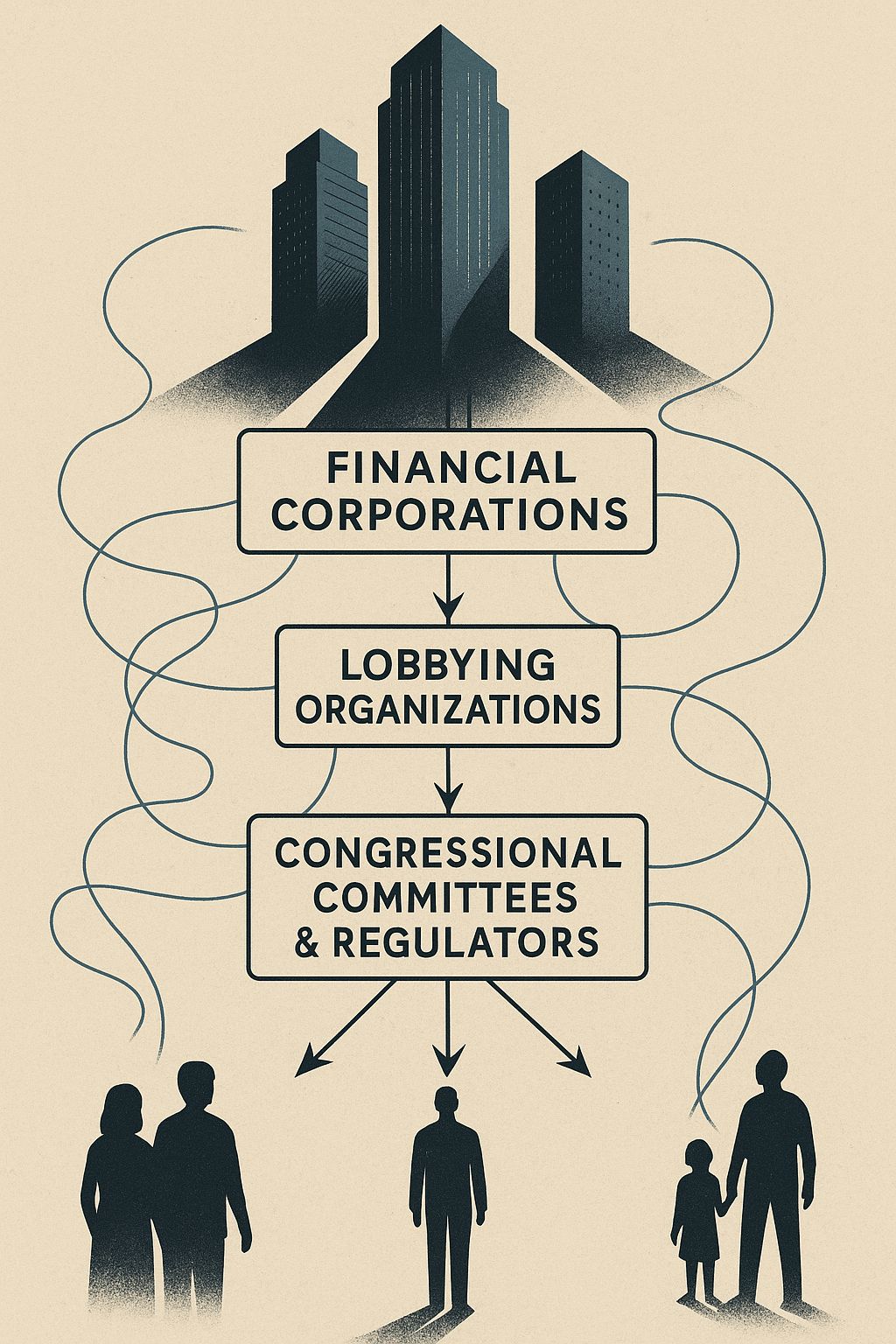

The Power Map: Who Really Shapes America’s Financial Policies

For decades, Americans have lived inside a financial system shaped not by voters, but by a web of policy actors who influence credit laws, banking regulations, insurance rules, and lending structures. This system didn’t evolve naturally. It was engineered over time by intersecting institutions whose interests often diverge sharply from those of ordinary families.

Below is the true architecture of influence — the network of committees, agencies, lobbies, and financial groups that determine how much we pay in interest, premiums, fees, and loan costs.

A. Congressional Committees: Where Policy Begins

Two committees quietly shape almost every modern financial rule:

1. House Financial Services Committee

Controls legislation related to:

Credit cards

Lending

Consumer protection

Insurance

Housing finance

2. Senate Banking, Housing & Urban Affairs Committee

Controls:

The Federal Reserve

Mortgage markets

National banking laws

Wall Street regulations

These rooms are where industry lobbyists concentrate their efforts, knowing a single amendment can reshape an entire market.

B. Federal Agencies: Where Rules Take Shape

These agencies translate laws into real-world policies:

Federal Reserve

Sets interest rates and credit conditions.

Treasury Department

Implements national financial policy.

Consumer Financial Protection Bureau (CFPB)

Regulates credit cards, loans, and consumer protections.

OCC, FDIC, and SEC

Oversee national banks, deposit insurance, Wall Street securities, and systemic risk.

Together, they decide how strictly the rules are enforced — or how leniently the industry is allowed to operate.

C. Lobbyists: The Most Powerful Force in the System

Lobbyists are the bridge between corporate interests and policymakers. They:

Draft bills

Provide “expert testimony”

Influence committee hearings

Host private policy retreats

Fund political campaigns

Major lobbying organizations include:

American Bankers Association

Financial Services Roundtable

Mortgage Bankers Association

AHIP & Blue Cross Blue Shield Association (insurance)

U.S. Chamber of Commerce

Their influence shapes what lawmakers even consider possible.

D. Think Tanks & Rating Agencies: The Intellectual Cover

Policy institutes frame the narrative. Credit rating agencies shape risk and lending behavior.

Think tanks:

Brookings

Heritage Foundation

Cato Institute

American Enterprise Institute

Rating agencies:

Moody’s

Standard & Poor’s

Fitch

Their reports guide lawmakers — but many receive financial-sector funding.

E. State Governments: Quiet but Powerful

Because of the Marquette ruling (1978), two states became national rule-setters:

✅South Dakota

✅ Delaware

They eliminated interest caps to attract credit card companies.

Today, every American’s interest rate is effectively determined by two state legislatures they cannot vote for.

Quick Chart: Who Controls What

Entity | Controls | Impact on You |

|---|---|---|

Congressional Committees | Credit laws, interest rules | Interest rates, loan terms |

Federal Reserve | National interest rates | Credit availability, loan costs |

CFPB & Regulators | Consumer protections | Safety from predatory practices |

Lobbyists | Influence on lawmakers | Weaker protections, higher costs |

State Governments (SD/DE) | Interest rate caps | Nationwide credit card rates |

Rating Agencies | Bank risk standards | Loan approvals, mortgage costs |

Think Tanks | Policy frameworks | How lawmakers justify decisions |

Reform Possibilities to Reduce Undue Influence

Here are structural changes that would meaningfully shift power back to the people:

1. Mandatory Public Disclosure of Lobbyist Drafted Bills

Voters must know when corporations write legislation.

2. National Interest Rate Caps (State-Right Restorations)

Undo the impact of Marquette and restore state-level protections.

3. Federal Recall Mechanism

When lawmakers stop representing their voters, they can be removed.

4. Public Approval for Major International Spending

Ensures tax dollars align with voter priorities.

5. Donor Transparency Scorecards

Quarterly reporting on political influence.

6. Strict Limits on Revolving-Door Employment

Prevent regulators from leaving for high-paying industry jobs immediately.

Empower the agency designed to protect consumers.

When Representation Fails, Democracy is an Illusion

Most Americans live paycheck to paycheck. They do not have the time or capacity to analyze every vote, bill, or committee hearing.

Politicians know this. Corporations know this. Lobbyists rely on this.

Without transparency and real accountability, elections are not enough to ensure representation.

That is why we propose federal accountability reform.

A System Where Everyone Prospers

A healthy economy is not built on extraction — it is built on circulation.

When households are financially stable, they:

Spend more.

Save more.

Invest more.

Start businesses.

Participate fully.

Businesses benefit when customers have spending power. Families thrive when they aren't burdened by debt. Communities strengthen when financial stress decreases.

This is not ideology. This is basic economic logic.

Prosperity grows when the people prosper.

A Federal Accountability Framework

To restore genuine representation, we propose the Representation Integrity & Federal Recall Act, which includes:

Quarterly Representation Scorecards

Each representative must report:

Voting record

Alignment with district polling

Donor influence

Constituent communications

Representation Mismatch Triggers

When a representative consistently votes against constituent priorities, a recall process can begin.

Federal Recall Petitions

If 10–20% of a district signs, a recall election must occur.

Special Election Replacement

No party interference. No donor influence. Only the people.

This is not radical. It is democracy protected.

Direct Public Approval for International Spending

Tax dollars come from the labor and sacrifice of the American people.

When billions are sent overseas while Americans face:

Rising debt

Housing insecurity

Medical bankruptcy

Food instability

…it erodes the legitimacy of our democracy.

Major international spending should require direct public consent.

A Two-Year Reform Timeline: Realistic & Achievable

Politicians claim reform takes decades.

That is not true.

Here is the real timeline when the public demands action:

0–3 months: Public pressure, viral awareness, constituent engagement. 2–6 months: Bill drafting by lawmakers and policy advisors. 6–9 months: Bill introduction. 9–15 months: Hearings and national debate. 12–18 months: Final vote in Congress. 18–24 months: Implementation and public roll-out.

Public momentum is the accelerator.

The Moral and Spiritual Responsibility

This is bigger than policy. This is bigger than economics.

This is moral restoration. This is spiritual alignment.

Systems built on exploitation do not stand the test of time. When people awaken to truth, the foundation shifts. When injustice becomes undeniable, reform becomes inevitable.

God does not stand with systems that harm the vulnerable. God does not bless structures built on greed. God aligns with truth, fairness, and justice.

When people remember who they are — when they declare I Am — they become impossible to deceive, suppress, or exploit.

This is not rebellion. This is correction. This is restoration.

The Call to Action: What Every Reader Can do Today

This movement becomes unstoppable when people act.

1. Contact Your Representatives

Tell them you support:

State-level interest caps

Federal recall mechanisms

Transparency scorecards

Public approval for major international aid

Consumer protections in credit, insurance, and lending

Change spreads through awareness. Share this with:

Family

Friends

Co-workers

Community networks

Social media platforms

3. Examine Your Own Financial Landscape

Knowledge is empowerment. Review your:

Credit card interest rates

Insurance premiums

Loan terms

Monthly extraction points

4. Build or Join Community Financial Networks

Community-based alternatives strengthen local stability. Look into:

Credit unions

Cooperative lending circles

Mutual-aid networks

Local investment groups

5. Stay Engaged

The system relies on exhaustion. Stay awake. Stay aware. Stay connected.

In solidarity and truth,

Lyndsay LaBrier

Merchant Ship Collective — Start small. Launch smart. Grow loud.

You’ve Hit Capacity. Now What?

You built your business by saying yes to everything. Every detail. Every deadline. Every late night.

But now? You’re leading less and managing more.

BELAY’s eBook Delegate to Elevate pulls from over a decade of experience helping thousands of founders and executives hand off work — without losing control. Learn how top leaders reclaim their time, ditch the burnout, and step back into the role only they can fill: visionary.

It’s not just about scaling. It’s about getting back to leading.

The ceiling you’re feeling? Optional.

References

American Bankers Association. (2024). Credit card market report.

Federal Reserve. (2024). Consumer credit — G.19 statistical release.

Karger, H. (2015). Shortchanged: Life and debt in the fringe economy. Oxford University Press.

Pew Research Center. (2023). Public trust in government: 1958–2023.

U.S. Supreme Court. (1978). Marquette National Bank v. First of Omaha Service Corp., 439 U.S. 299.